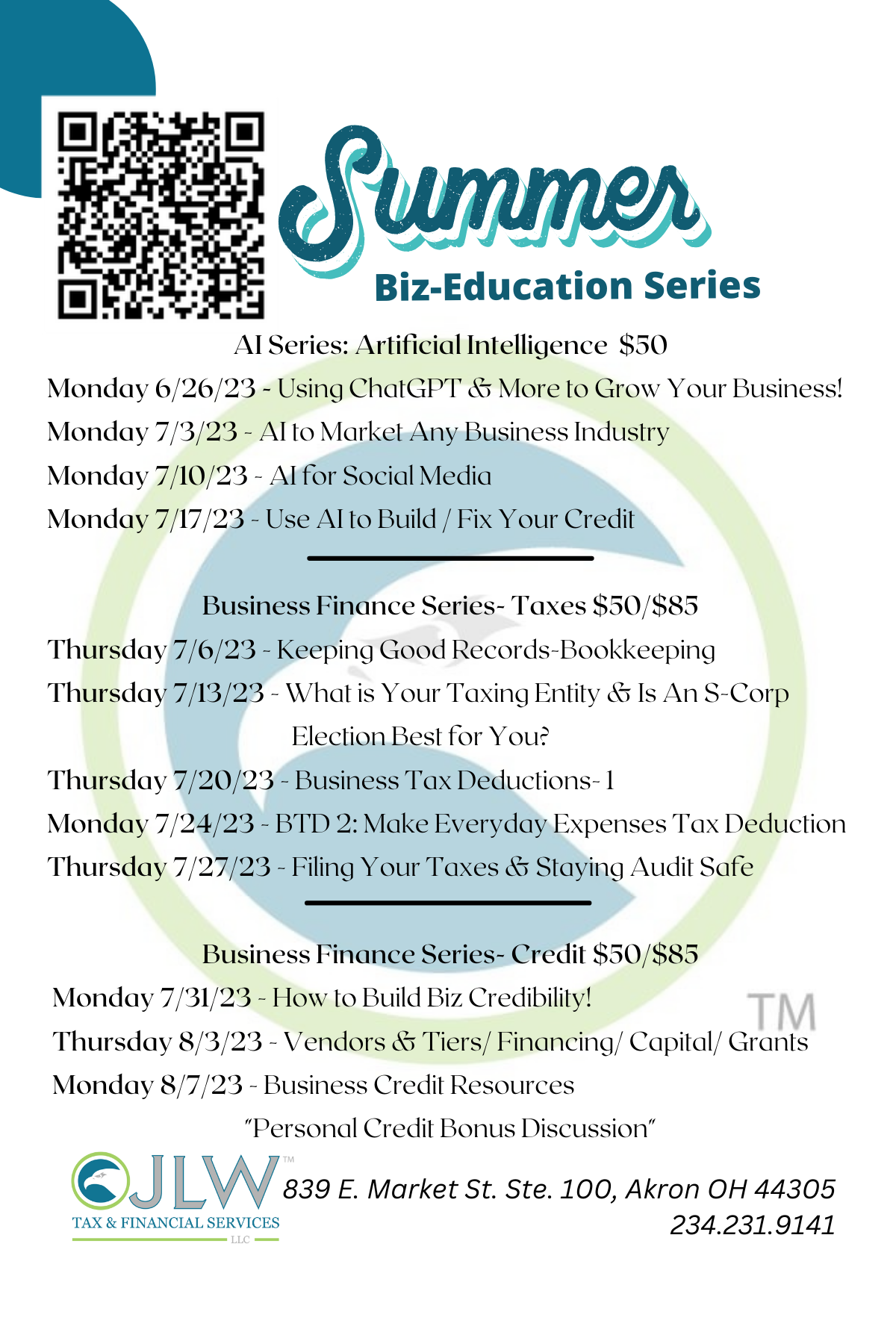

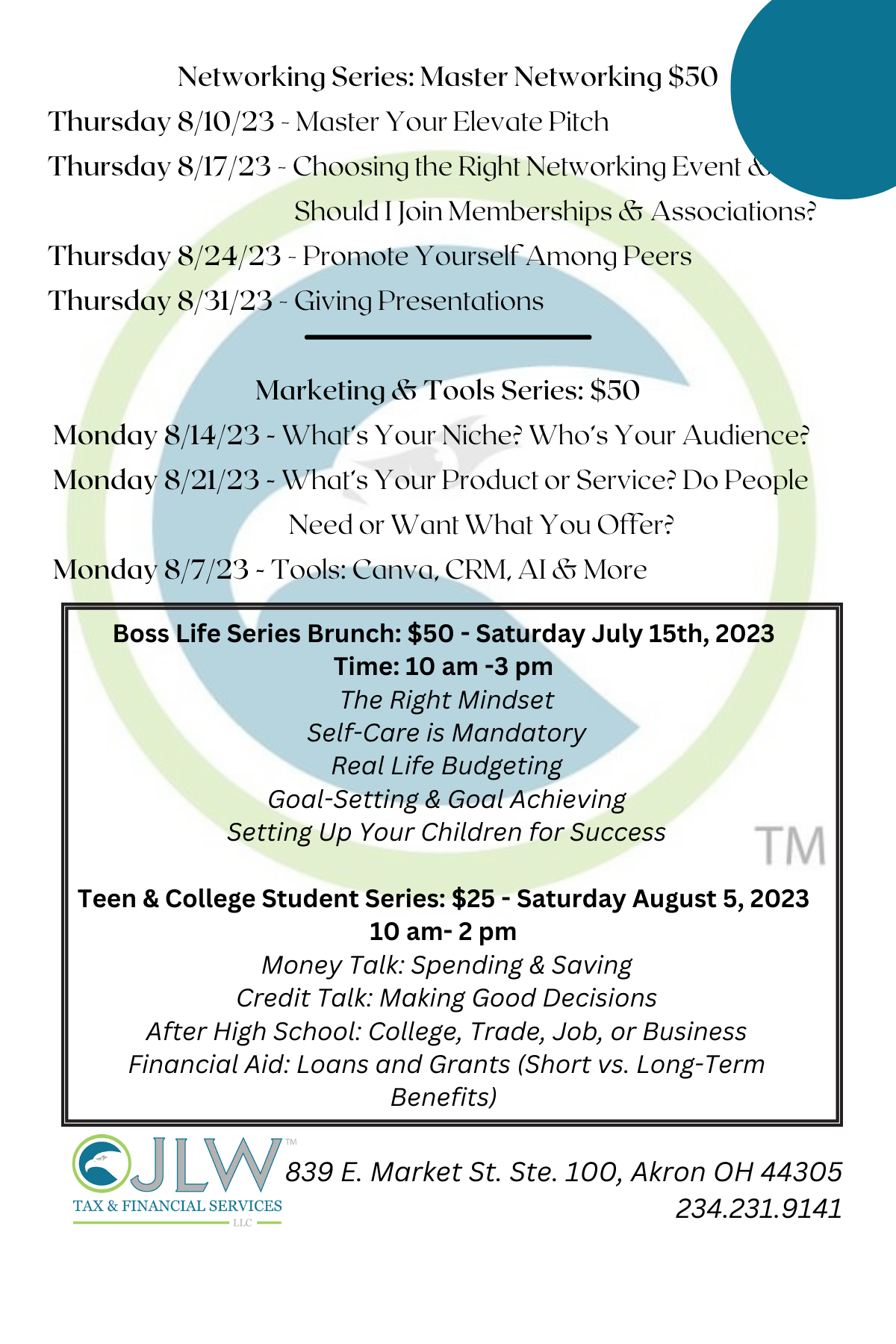

2023 Summer Biz-Education Series Registration Forms

Grow Your Business With the Knowledge that You Need!

2023 Income Tax Preparation Courses

Topics may include:

Responsibilities of a Tax Professional

Due Diligence

The Tax Return Preparation Process

Taxpayer Identification Numbers

Filing Statuses and Who Should File a Tax Return

Personal and Dependency Exemptions

Income – Part I

Income – Part II

Self-Employment Income

Standard and Itemized Deductions

Credit for Child and Dependent Care

Child Tax Issues

Credit for the Elderly or Disabled

Sale of Investment Property

Sale of Home

Adjustments to Income – Part I

Adjustments to Income – Part II

Individual Retirement Accounts

and More……

Next Class Start Date: TBD

Duration:

1-4 Weeks: Self-Paced Course with Weekly Webinars

5-6 Weeks: Self-Paced Software Training with Weekly Q&A Sessions for Tax Partners

Live Webinars: TBA from 6:30-8:30 pm EST.

Online Coursework: Self-Study and Recordings with Reference Materials and Take Course Quizzes/ Tests

FINAL CLASS: TBA

Tax Business 101: Included for all Tax Partners.

Price is TBD, payment plans available.

Limited Space

Learn to Make $10,000-$100,000 in 4 Months Preparing Taxes!!

Income Tax Preparation Course

Course Refund Policy:

It is always our goal to make sure that our students receive instruction that is not only thorough in knowledge, but simple enough to understand. We hope they will be satisfied with the course that they enroll in. We will make every effort to accommodate our student’s needs. Still, it is our understanding that situations may arise preventing an individual from taking or continuing the course that they have paid for. Generally, we do not offer monetary refunds, but exceptions may be made for special circumstances. All refunds must be requested in writing via fax or email and also approved by the Owner or an authorized Manager. JLW Tax & Financial Services LLC and its affiliates/ partners reserve the right to change this policy at any time, or deny any refund request. Contact us for a detailed copy of our refund policy and procedures.